The Key to Obtain Financing for Grain Merchandising

The end of summer brings thoughts of planning and profitability. Grain companies that buy grain from producers and sell it immediately to users of...

Volatile prices mixed with a need to build working capital and equity pushed inventory repurchase agreements into the grain elevator financing and Mark to Market discussion for grain companies.

Volatile prices mixed with a need to build working capital and equity pushed inventory repurchase agreements into the grain elevator financing and Mark to Market discussion for grain companies.

An inventory repurchase or “Repo” is an agreement to sell a specific number of company owned bushels to a third party with the agreement that you will repurchase the same bushels at a set basis at a specific time in the future. The sale immediately gives cash to the company at the same time it eliminates margin calls by transferring the futures positions. The fee should be set at the time the agreement is signed, keep in mind the lender of last resort typically comes at a high cost and Repos are no different.

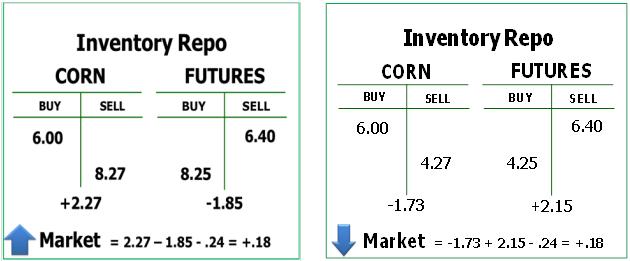

For example: On January 1st the bank purchases 1 million bushels of corn at -40July with July Futures trading at $6.40. The total price paid by the bank is $6,000,000 or $6.00 per bushel. Warehouse receipts are transferred to the bank and the money is sent to the elevator. At the same time a sales contract is executed that contains terms for the sale of the bushels back to the elevator. The basis is set at +2July on a basis contract with the futures fixed on a specific date (June 15th). The contract includes a storage charge at the prevailing rate of $.24 that must be paid by the bank to confirm ownership of the position. The total fee generated from the repurchase agreement is $.18/ per bushel. The terms for early termination should be clearly written into the contract.

The bank is accepting $.18 per bushel instead of the interest charges on the position, and the elevator is paying a premium to no longer have margin call exposure on this position.

Projected interest cost on $6,000,000 at 4% for 5.5 months $110,000 / $.11 per bushel

Estimated cost of Commodities Swap January 1st/ June 15th $40,000 / $.04 per bushel

Estimated banker premium $30,000 / $.03 per bushel

Bank receives $ .18 per bushel or 6.5% for 5.5 months

($180,000 / $6,000,000) X (360 days / 165 days) = 6.5%

The elevator pays the fee and spans time and potential volatility at a fixed price. This product is insurance against a market rally and is typically priced for a $2 to $4 market move.

To learn more about and Mark to Market Grain Accounting and the financial implications of repurchase agreements please sign up below for one of our finance courses.

The end of summer brings thoughts of planning and profitability. Grain companies that buy grain from producers and sell it immediately to users of...

Volatile prices and the difficulty accessing credit during peak financing periods opened the market to provide commodity futures swaps as a method of...

Historical business truths typically come from very simple concepts. “Price is what you pay. Value is what you get” (Warren Buffet). “A penny saved...