Minimum Price Contracts: The Case for Choosing Shorter Periods of Time

There is a risk of loss in futures and options trading. Past performance is not necessarily indicative of future results. When farmers enter into a...

2 min read

Sherry Lorton

Oct 8, 2024

Sherry Lorton

Oct 8, 2024

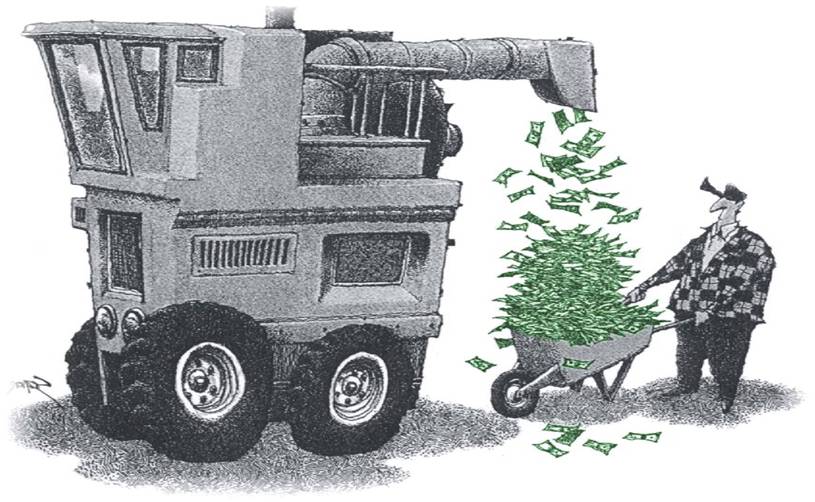

When offering Minimum Price Contracts (MPCs) as a marketing tool to farmers, it’s essential to clarify a key point: the elevator isn't buying call options for the farmer. Instead, the elevator buys the call option for itself to cover potential obligations. By doing this, the elevator secures a minimum price for the farmer’s grain and opens the door to benefiting from any rise in the futures market above a set price within a certain timeframe—for an agreed-upon fee.

FREE DOWNLOAD: Minimum Price Contract Quick Reference Guide

Breaking Down MPCs for Farmers

As a merchandiser, explaining the elements of the MPC contract clearly can prevent misunderstandings. The cash portion of the contract is locked in when the minimum price is established. At this point, the elevator buys the grain and sells futures. This action sets the basis for the elevator and a floor price for the farmer, making it identical to any typical cash grain transaction. Once the cash part is complete, the farmer should no longer be concerned with cash market fluctuations.

The upside potential comes from the call option the elevator buys to facilitate the MPC. The cost of this option is passed on to the producer, either through an invoice ahead of harvest or as a deduction from the grain settlement when the grain is delivered.

The Objective: “A Floor and Maybe More”

Often referred to as “a floor and maybe more,” MPCs guarantee a minimum price while offering potential future gains. Farmers, however, may focus too much on the “maybe more” part and downplay the value of the floor. As a merchandiser, it’s critical to emphasize the floor's value to reduce frustration down the road. MPCs should be viewed as price insurance rather than a way to chase market gains.

Some farmers may choose to self-insure by remaining in the cash market, using storage or delayed pricing (DP). When comparing DP or storage with MPC contracts, consider basis and any storage fees. The cost comparison may vary, and it’s important to focus on the value of the floor price and allow the farmer to choose their preferred approach.

Re-pricing and Clear Communication

The re-pricing element of an MPC is crucial. The farmer should watch the futures market, not the cash market. Once a predetermined futures price is set, the producer can benefit from any increase above that price, penny for penny, with one opportunity to re-price. Keep your explanation simple—avoid technical option terminology like strike price, intrinsic value, or volatility. Instead, refer to the strike price as a base futures price and the option premium as a fee, making the contract more accessible to a wider audience.

Mechanics of MPC Contracts

MPCs are most popular with farmers who need a floor price or require money at harvest. Your ability to clearly explain the structure and benefits of these contracts can make a significant impact on their success with producers. By simplifying the details and emphasizing the value of price protection, you can offer MPCs as a valuable tool in a farmer’s marketing strategy.

There is a risk of loss in futures and options trading. Past performance is not necessarily indicative of future results. When farmers enter into a...

Understanding the Idea of Minimum Price Contracts

The typical grain marketing discussion that occurs with a farmer at the elevator or coffee shop centers a lot around price. What are prices doing?...