What Are “Basis Eyes” and Why Are They So Important?

There are several different ways to say it, but at the core having basis eyes means

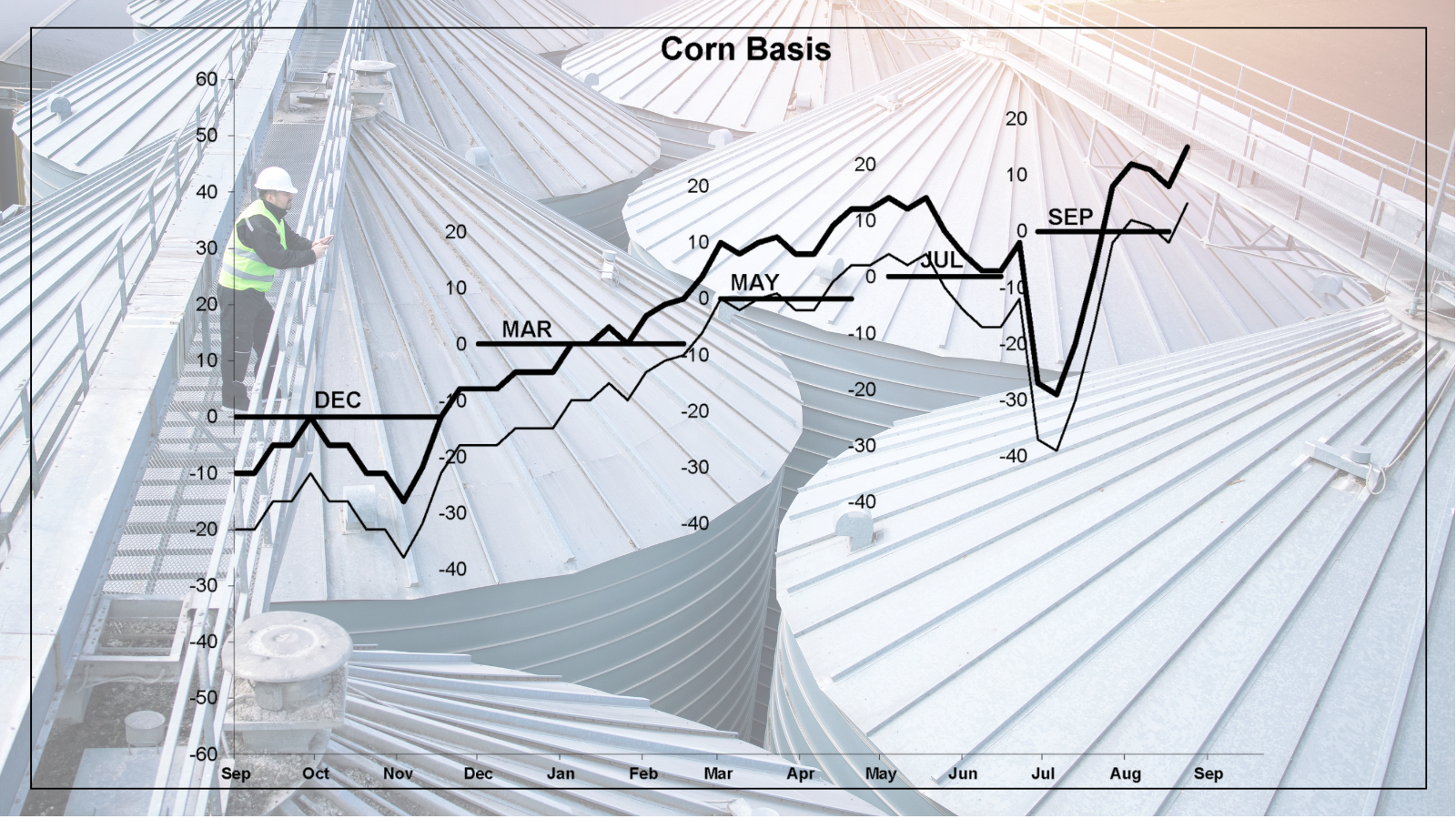

The 2023-24 crop year was a transition away from inversion and into carry for corn and soybeans, which typically involves some of the characteristics of both types of markets.

What is shaping up to be another large harvest overall means that we’re likely looking at a classic carry market in both crops for the 2024-25 merchandising season.

It feels like a long time since we’ve had a carry market with low basis to start the season. This is the first carry market for some newer traders, so it seems useful to review some characteristics of this basis trading environment.

Lower Volatility

Price, spreads, and basis all tend to trade at lower values (i.e., larger carry in the case of spreads) and vary from those values less. This doesn’t mean that big swings can’t or won’t happen but that they tend to happen less often, and the swings tend to be less dramatic.

Less Urgency From Users

In inverted markets, users are focused on maintaining a steady supply and are willing to pay for peace of mind that the bushels will be there.

With ample supplies available, the focus switches to not overpaying. This requires sellers to have firm basis targets (and good reasons for them) and be offer-makers who are ready to say “yes” immediately when a buyer is interested.

Note that if you are in an area where a smaller local supply is expected, you should be ready to sell inflated values very early in the season before bushels from abundant areas find their way to your neighborhood.

Buy Basis Matters

Inverted markets tend to offer plenty of good short-term selling opportunities so that even if you overpay for grain, you can be rewarded if you don’t wait too long.

Carry markets make it highly important not to overpay, and especially at harvest. It is difficult if not impossible to trade your way out of paying too much.

Get Targets

Speaking of buying in less volatile markets, getting firm price targets from farmers is key to creating a win-win scenario. When rallies occur, they will be at times no one was expecting, for reasons nobody is expecting, and will be shorter in duration than anyone wants them to be.

While logistics, cash flow, grain quality, and other practical pieces of the grain business will impact how you approach this season, margin comes down to how well you can manage buy basis, sell basis, and spreads.

Match your basis trading approach to the prevailing environment. Pay a basis that is fair to you, arrive at a rational and defensible opinion of post-harvest basis values, be an offer-maker, and think of spreads as a connector of transactions rather than something to be traded in a vacuum.

Best of luck with this fall’s harvest and the upcoming merchandising season.

There are several different ways to say it, but at the core having basis eyes means

The country elevator is in an enviable position to serve as a price neutral conduit for grain from producers to end users. In order for this to work,...

Cambridge dictionary defines waste of space as “a person or thing that is not useful or helpful.” In the grain storage business, it is our...