Navigating The Bermuda Triangle of Grain Repos and Grain Swaps

This week's blog will answer some frequently asked questions regarding some alternative grain company financing tools. For a general overview of...

Where much is given, much is required and this is certainly true with collateral audits. The increased grain elevator financing requirements have brought a much higher level of operating loan documentation. This section will show how to bring the essential paperwork together and show the thought process behind each form.

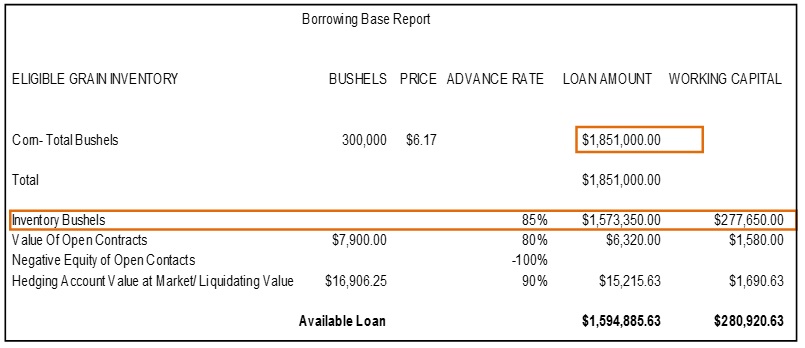

The collateral audit or borrowing base reconciliation typically occurs once a month unless the grain company is up against a lending limit or market volatility is peaking. The borrowing base report is designed to verify for the bank that the grain company has the assets and liquidity to support the operating line. Each asset is given a predetermined advance rate based on the perceived risk of that asset. If the bank believes grain inventory is easier to turn to cash than a receivable you will receive a higher advance rate for the inventory. Advance rates are negotiable just like interest rates, and when the markets rally most borrowers are not as concerned about what rate they are paying as long as the money is available to fund their position.

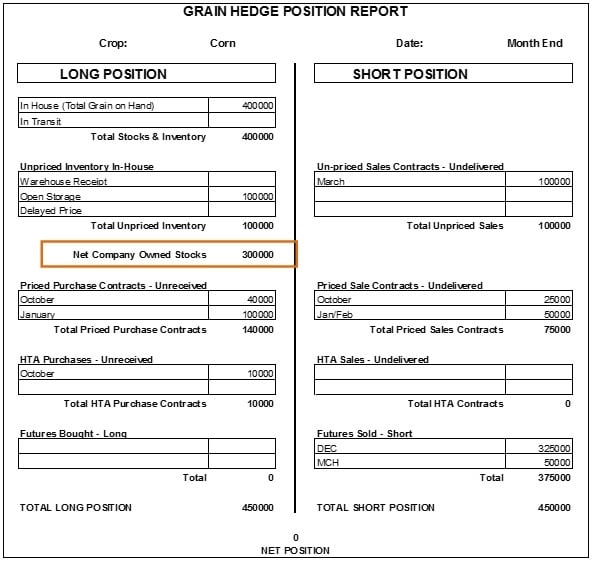

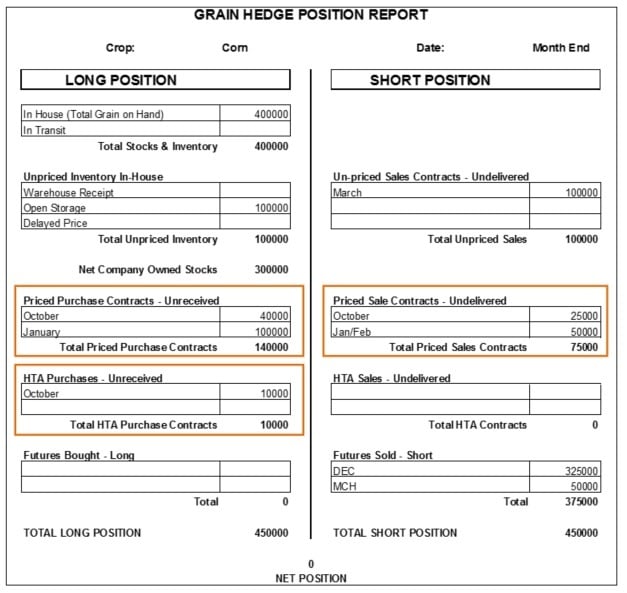

Inventory numbers in grain accounting are typically obtained from the Daily Position Record or Grain Hedge Position Report at the end of the month. The bank is looking to participate in financing grain inventory that is owned, paid, and properly hedged. To get comfortable financing the position, multiple reports including the financial statement will be tied together starting with the Grain Hedge Position Report which will show the number of bushels financed.

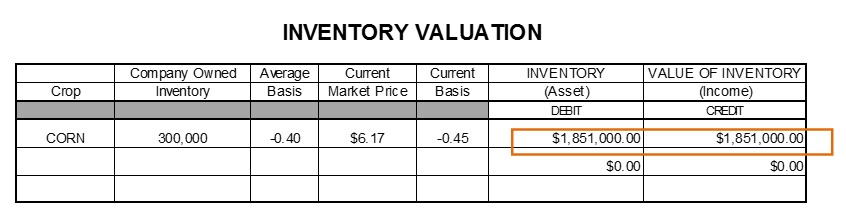

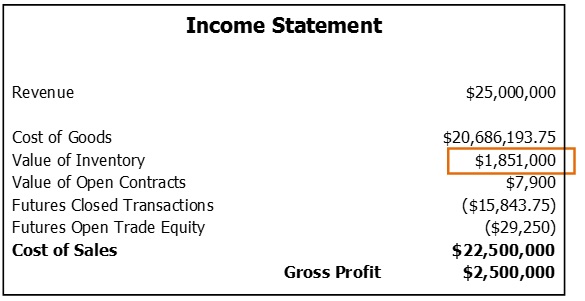

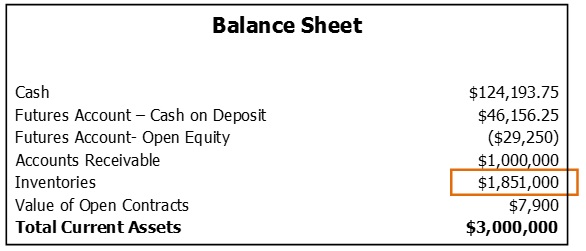

The inventory valuation worksheet reports those bushels and marks them to market. These numbers will flow to your balance sheet and income statement.

These numbers will flow to your balance sheet and income statement.

Finally, these general ledger entries are put into the Borrowing Base for the grain company. In this example, inventory is given an 85% advance rate. As the inventory position and futures markets rise and fall, the loan amount available will change but the advance rate will stay the same. The elevator must always keep 15% of the grain value available in working capital to support this position. For every $1 in corn at the elevator no more than 85% of that value will come from the bank. It is critical that the elevator stress tests the credit line and working capital position for potential rallies.

This week's blog will answer some frequently asked questions regarding some alternative grain company financing tools. For a general overview of...

Forward contract financing has become an essential piece of the grain elevator financing package. The modern day elevator must be able to help...

Volatile prices and the difficulty accessing credit during peak financing periods opened the market to provide commodity futures swaps as a method of...